All Categories

Featured

Think About Using the cent formula: penny means Financial debt, Earnings, Home Loan, and Education and learning. Total your financial obligations, home loan, and university costs, plus your income for the variety of years your household needs protection (e.g., until the children run out the residence), which's your coverage requirement. Some financial specialists determine the quantity you need using the Human Life Worth ideology, which is your lifetime income prospective what you're gaining currently, and what you expect to gain in the future.

One way to do that is to search for business with strong Economic strength scores. the term illustration in a life insurance policy refers to. 8A company that underwrites its very own plans: Some firms can offer plans from another insurance firm, and this can add an additional layer if you desire to transform your policy or down the roadway when your household needs a payout

Term Rider Life Insurance Definition

Some business offer this on a year-to-year basis and while you can anticipate your prices to climb considerably, it might deserve it for your survivors. An additional way to contrast insurer is by looking at online client reviews. While these aren't likely to tell you a lot concerning a firm's financial stability, it can inform you just how very easy they are to function with, and whether claims servicing is a trouble.

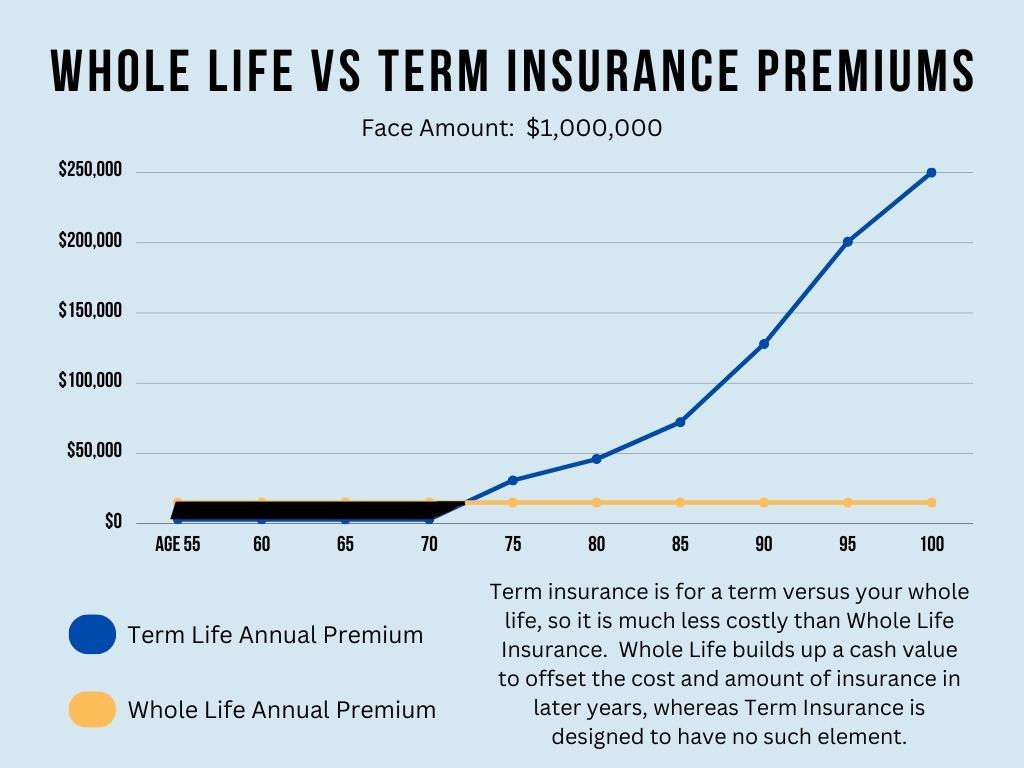

When you're more youthful, term life insurance coverage can be a simple means to secure your liked ones. As life changes your economic top priorities can also, so you might desire to have entire life insurance for its life time insurance coverage and extra benefits that you can utilize while you're living.

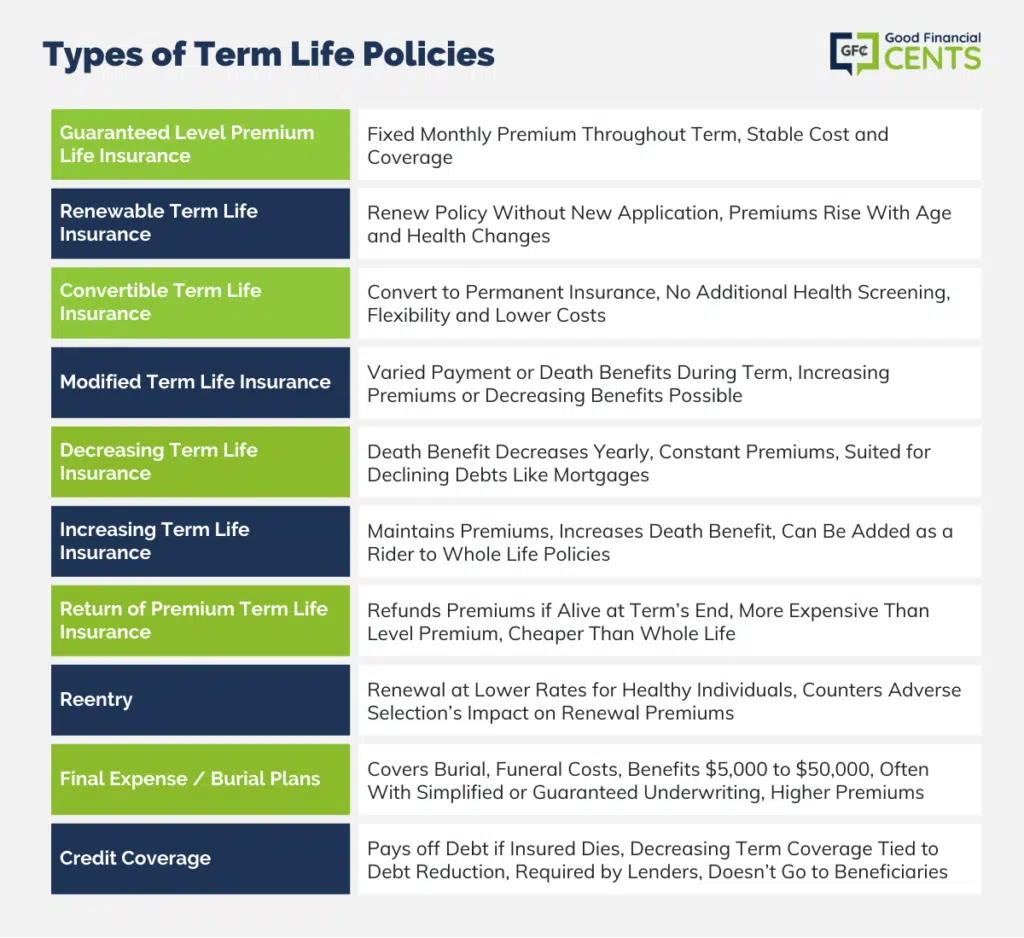

Authorization is ensured no matter your health. The costs will not raise as soon as they're established, but they will go up with age, so it's a great idea to secure them in early. Figure out even more regarding exactly how a term conversion functions.

1Term life insurance coverage uses momentary security for a vital period of time and is normally much less costly than long-term life insurance policy. decreasing term life insurance is no longer available. 2Term conversion guidelines and limitations, such as timing, may apply; for instance, there might be a ten-year conversion benefit for some products and a five-year conversion opportunity for others

3Rider Insured's Paid-Up Insurance coverage Acquisition Choice in New York. There is a cost to exercise this motorcyclist. Not all participating plan owners are eligible for returns.

Latest Posts

What Effect Can A Long-term Care Benefit Rider Have On A Life Insurance Policy

Term Life Insurance Pays Out Dividends

Best Term Life Insurance Malaysia